Now, what's interesting is how things seem to be lining up across several markets, starting with COMPQ:

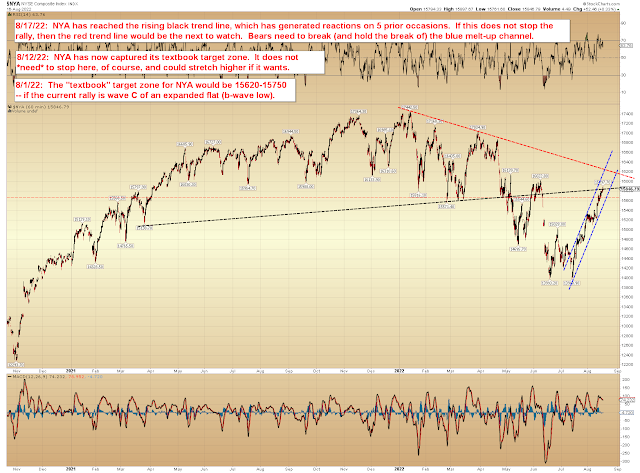

NYA also tagged a trend line that has been relevant to that market in the past:

And remember TLT, which I noted a couple weeks ago?

Interesting how that trend line above lines up with the 200-month MA on the 10-year yield:

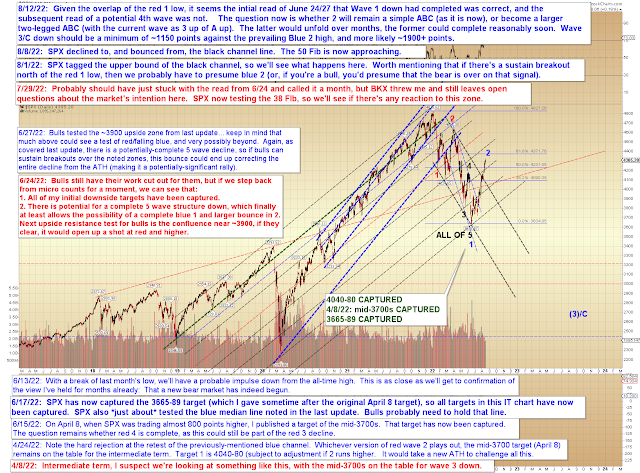

No change to the big picture, and I still believe this is a bear market rally:

In conclusion, multiple markets have tagged potential resistance zones concurrently, and that may cause a negative reaction. It's interesting how these all line up not only with each other, but also with the release of the Fed minutes today. Treasury (smart money) yields began rising a couple weeks ago, when TLT tagged the trend line noted in the 4th chart on August 5, but the market (dumb money) has ignored that so far, in hopes that the Fed will decide that the 8.5% inflation of July is just so much better than 9.1% inflation (from June) that we can happily resume the free-money-party of the past decade-plus. Which seems like a silly thing to hope for.

In other words, if bears are going to show up again, this is as good a time as any for that to happen. Maybe even better. Trade safe.

No comments:

Post a Comment