The simple fact is, markets are not rational, as everyone knows deep down -- they are often driven by emotion; specifically, the emotions of fear and greed. At least, that's the commonly accepted wisdom. I think "fear and greed" are an oversimplification of more complex forces, but I agree that emotion plays a big part, as any trader knows (given that they've experienced many an emotion themselves while trading!).

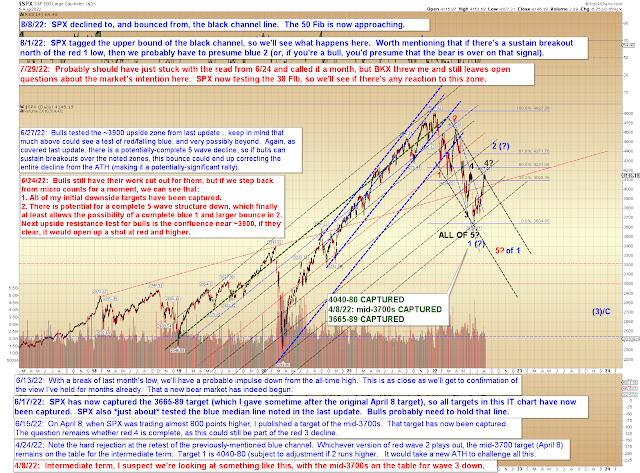

On Friday, everything "seemed," on a rational level, to be set up for a fall, but the market was having none of it, and instead found buyers at the black trend line that I discussed in the last update:

Zoomed-out, we see the same trend line again, and the current wave is starting to have the psychology of a second wave: During second waves, many people assume the bear market is over and there's great hope that the worst has passed and things are returning to "normal." (That we were about to enter a second wave was my first instinct back on 6/24 and 6/27 (before BKX threw me for a loop), as the annotations from those dates show.)

From a technical standpoint, it could still be either a fourth or a second (red 1 is the dividing line).

NYA is still below its "textbook" target zone:

We have to remember that bear markets do not head "straight to zero" and, as I've talked about several times previously, this (presumed) bear is expected to unfold over years -- which means there are going to be many decent bounces along the way. Which, really, is the way even bears should want it, because it's hard to make money as a bear if you're never given any short ops.

In conclusion, SPX managed to hold the zone it needed to hold, so we'll see if bulls can get (and hold) back above the recent highs (sometimes trend lines act as support/resistance, but then the market encounters resistance/support again near the prior high/low and the trend line is tested a second time (and possibly broken)). Trade safe.

No comments:

Post a Comment