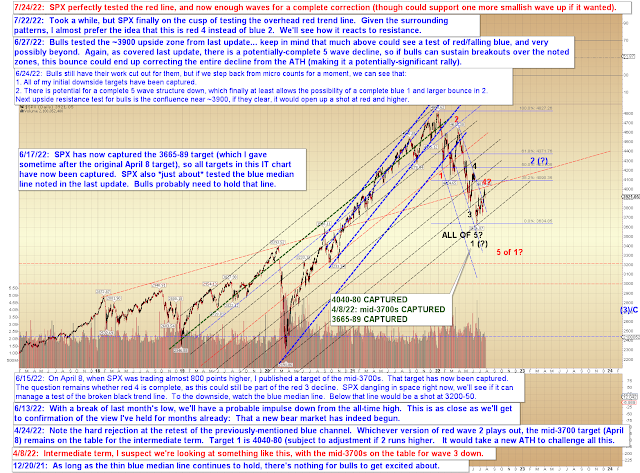

I haven't updated anything on the SPX chart below, because Stockcharts is still deleting my annotations and making me redo all of them (part of the New Cruelty at Stockcharts), but the only things I would add are that:

1. SPX overlapped the black A/1 high, which is generally not bullish

2. Nevertheless, in the event of a breakout, there is potential resistance not far above, in the 4085-4100 zone:

Not much to add in BKX:

COMPQ is backtesting/flirting with possible overhead resistance:

While the SPX intermediate chart suggests that even if there is a breakout over the ~4012 high, the market is going to run into red resistance again, just above that high (since that's a rising trend line):

In conclusion, today is a Fed day, so the market usually finds a way to kill time until the announcement. Given the larger pattern in BKX, I continue to lean toward the idea that the final low isn't in for this wave yet -- the question seems to be more whether the high is in yet. I suspect it's either in, or it's reasonably close (as noted on Monday, several markets, including SPX, could support another smallish wave up). Of course, we have to know the flip side of the coin, and in the event SPX were to sustain a breakout over the 4100 zone on increasing momentum, then I'd need to reassess. Trade safe.

No comments:

Post a Comment