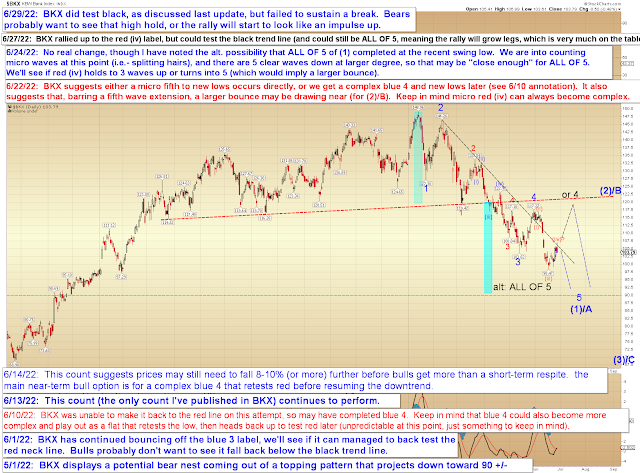

First up is BKX:

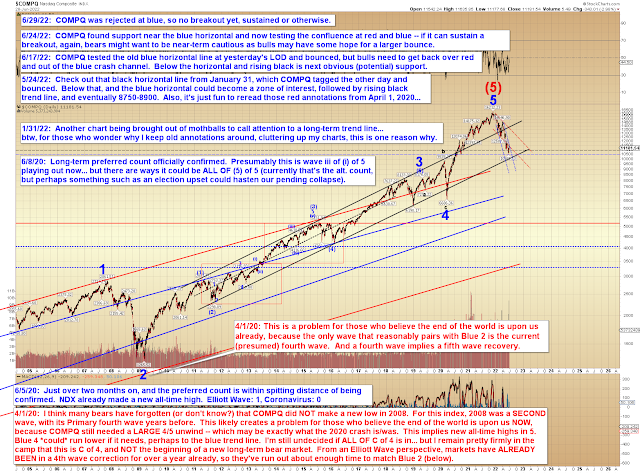

COMPQ was rejected right at the previously discussed blue trendline:

Next is NYA, which also shows a clear "three up" (three up is the inflection zone for a corrective ABC rally) so far:

Big picture, SPX ran a bit past the original upside target zone, but fell short of the next one (so far):

Near-term, I've noted some zones to keep an eye on:

In conclusion, last update noted that the market could have a near-term reaction here, and it did. At this point, it's quite clear what bulls need to do and where bears might want to step aside (yesterday's high) -- and while it's not quite as crystal-clear what bears need to do (there are zones, but no "hundred-percenters"), it is worth noting that they haven't done any of it yet. Trade safe.

No comments:

Post a Comment