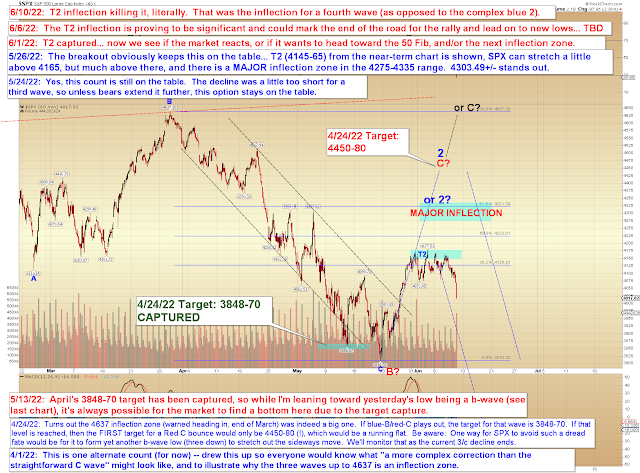

In conclusion, futures are indicating a gap up, but my very slight lean right now is that this will present a selling op. If SPX clears 4178, then red C is (obviously) still unfolding, though it could be in a fifth wave in that event. Short version: Unless SPX clears 4178 on increasing momentum, bears may have a solid shot here.

Today, it's obvious that the gap up toward the ~4160 zone was indeed a selling op, considering that right now futures are pointing to an SPX open around 200 points below Monday's "gap up" sell zone. And while I hesitated to call that a hit on Wednesday, due to the complex flat pattern that developed, I can now officially say that Monday (and Wednesday, for that matter) calls were a hit.

Next, I tried to draw some trend lines on the chart below, but Stockcharts deleted them, so after 3 tries, I gave up.

After bouncing off the blue 3 label, BKX likewise shows the potential of a completed fourth wave:

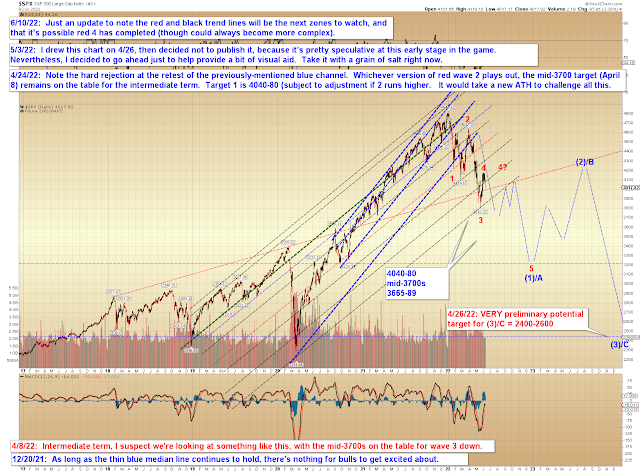

Finally, this chart isn't really a projection per se, it's more of a visual aid:

In conclusion, they say "they don't ring a bell at the top," but Monday and Wednesday's updates were hopefully the next best thing for readers. Trade safe.

No comments:

Post a Comment