Sigh. This is what happens when Keynesianism (or any other theory) becomes entrenched in our ruling class. Eventually there are no voices left to say, "Hey, maybe we're a little off on this." It just become an echo chamber. I haven't even checked lately, but are we still blaming "Putin"? Because that would be pretty funny, inasmuch as oil has since frequently traded below the price it was on the first day of Russia's invasion, and did so again this week. (Plus, of course, inflation began its current trend well before the invasion.)

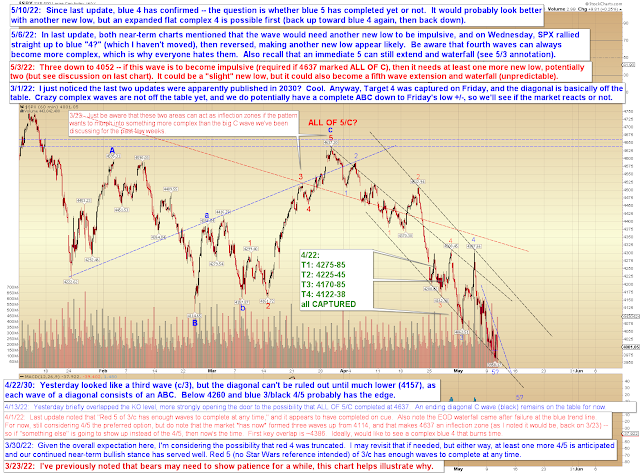

Anyway, don't get me going on all this. Let's get right to the charts. Blue 4 was confirmed since last update:

In a perfect world, SPX looks like it probably needs another low to be a complete wave, though (please read the entire annotation here):

If we bounce immediately, then we're probably working on the smaller-scale expanded flat that shown above, and not on the larger expanded flat we've been discussing as an option (below); at least, that would be my first instinct, due to the near-term chart appearing to need another wave down:

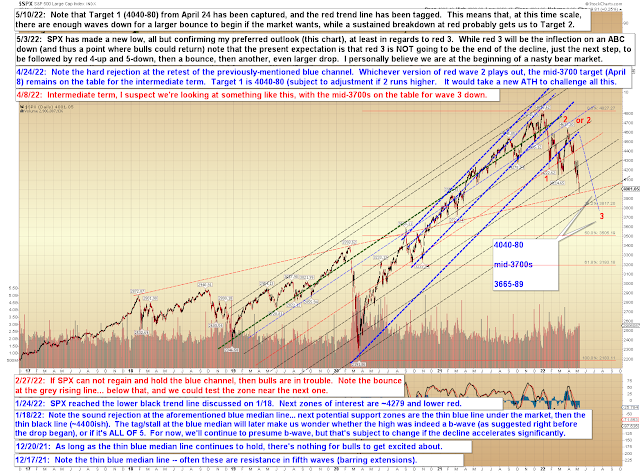

Bigger picture, the first downside target has been captured:

In conclusion, if SPX does not make a new low in short order, then we may be working on the smaller expanded flat 4th shown in chart two. If it does make a new low directly, then bulls will want to be cautious if there's any acceleration, as this is a decent setup for an extended fifth. Also, please keep in mind that if the fifth does not extend, then the fifth wave simply completes the larger wave for this leg of the decline, and that leads to a decent-sized corrective bounce. Trade safe.

No comments:

Post a Comment