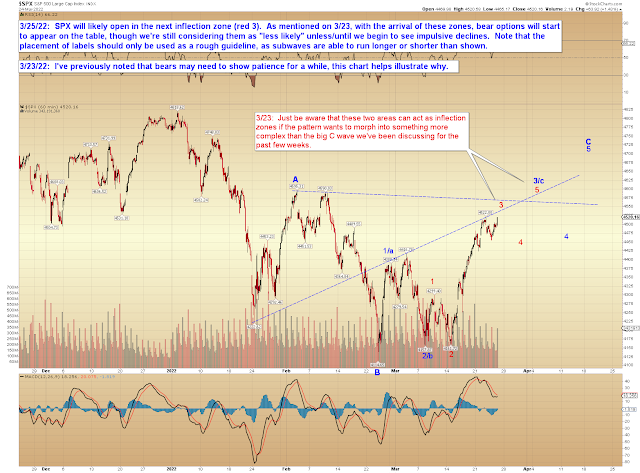

At least, for now we're going to presume that the next correction will be a fourth wave. As noted on the chart, we are getting into territory where some of the more complex patterns, such as a WXY (which is a pattern that would give bears a larger drop than the mere fourth wave does), at least become possible, though not necessarily likely yet. Patterns such as the WXY have to be treated as outliers, not because they're impossible, but simply because they show up with far less frequency in these types of positions. In the end, though, it's often a game of probabilities, and sometimes the roulette wheel lands on 00, even with the odds stacked against it -- which is why I mention these other options, even if I'm not "betting" on them at this stage.

In conclusion, this week has been a hit for the preferred count, and while other patterns are becoming possible, we'll continue to lean toward the "big C wave" count until the market gives us some sound reason not to. Trade safe.

No comments:

Post a Comment