I keep trying to drive home the idea that the near-term just doesn't matter much here. As I mentioned elsewhere, it's probably not wise to get too hung up picking up pennies on the track when a freight train is bearing down on you at full speed.

So once again, as clearly as I can state this: Since December 2021, I have been, and remain, bearish until proven otherwise.

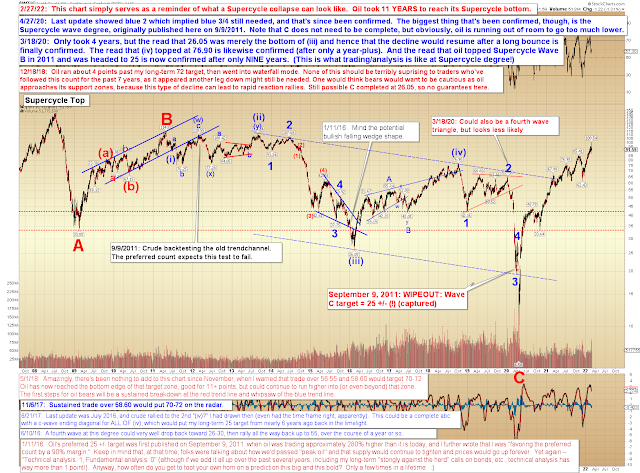

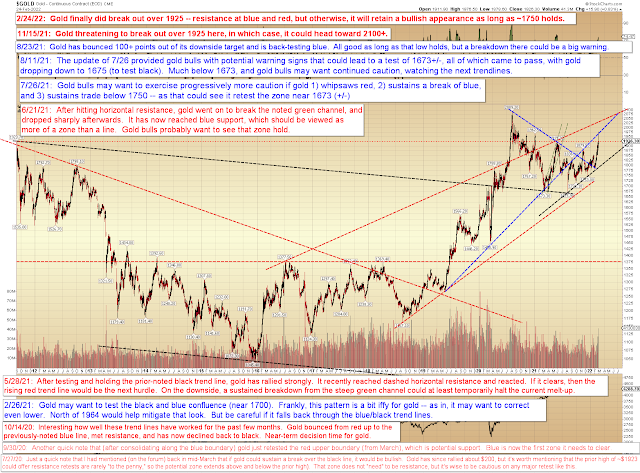

Along those lines, I was combing through my chartbook this weekend and came across the chart below, which was first published on May 1, 2020 within the piece "Is America Approaching the End of a Supercycle Rally?"

Here's the chart as first published (see link above), nearly two years ago:

Here's the chart now, with nothing moved:

Ignoring the fact that both the timing and price are completely ridiculous, that chart helps illustrate why the near-term just isn't where our focus should be right now.

Also, I'm leaning more and more toward this being Supercycle V instead of III, so make of that what you will.

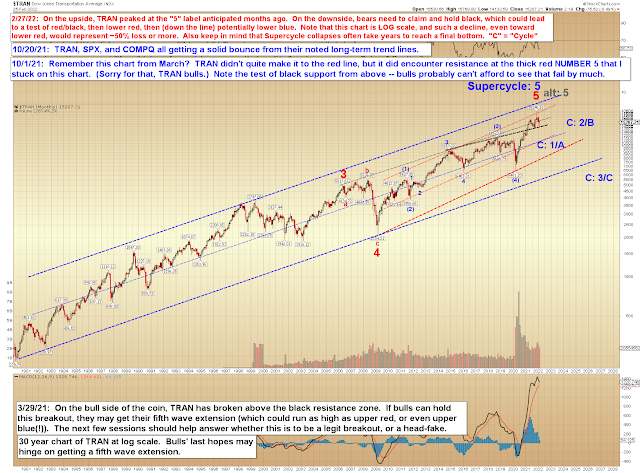

Nevertheless, here's a more "optimistic" option, via TRAN;

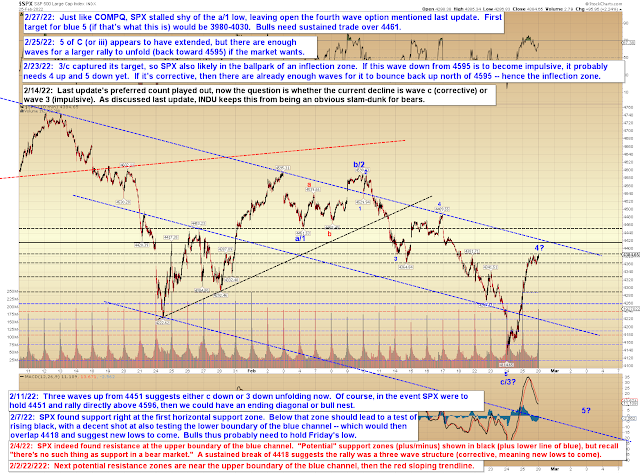

A closer long-term view on SPX reveals what bulls need to do to get back in the game here:

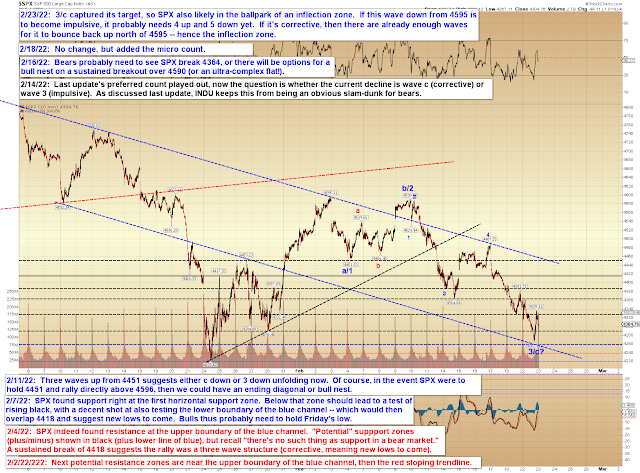

Near-term, if the idea that there are only three waves into the low is correct, then the primary options are "bearish now or bearish later":

SPX likewise stalled short of overlapping wave A/1, leaving both the "bearish now" and the "bearish later" options on the table:

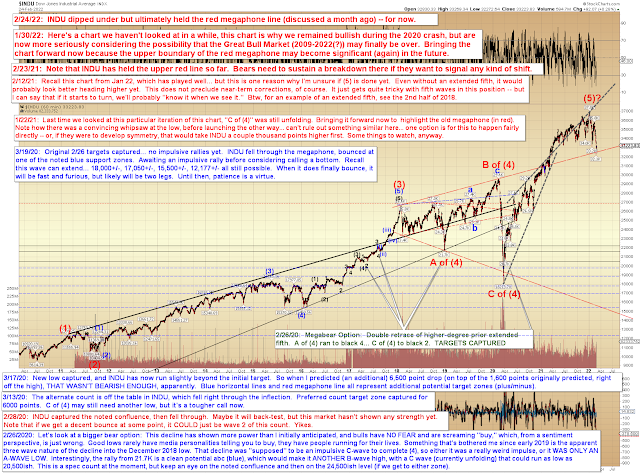

Finally, a reminder of how big a Supercycle wave can be:

In conclusion, the new low last week does help bears and brings the odds that a long-term bear market has begun closer into their favor. Bulls aren't entirely out of the game yet, but their chances are dwindling. Trade safe.