Other than that, not much to add. ("Other than that, Mrs. Lincoln, how was the play?")

Although I should mention that I noted in the forum during the session yesterday that, near-term, I suspect yesterday's low in SPX is a b-wave, meaning the market should break that low.

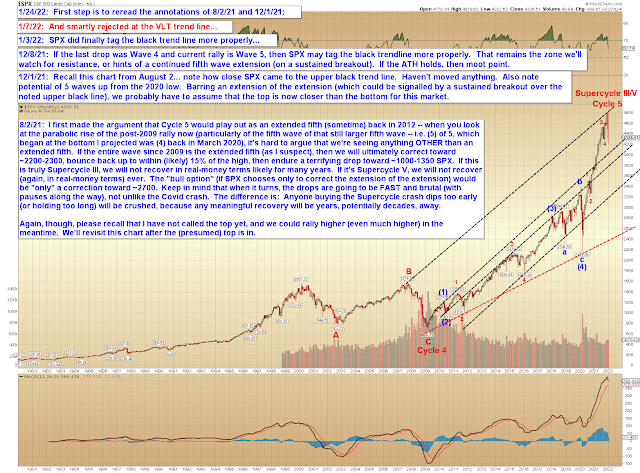

Note that SPX has, so far, been unable to sustain trade back above black (cue AC/DC):

In conclusion, while I spent most of December warning that it was "Time to Sell the Rallies," to reiterate: if SPX/ES sustain a break of this month's low, odds will increase that a true bear market has finally begun. Here, I'd like to quote a bit from one December update:

Now, here's the "market point": The Covid crash was a pretty clear fourth wave. That means we have almost-certainly been riding out the fifth wave ever since. And the fifth wave is the final wave of a move -- which, now that we're finally getting into a potentially-complete wave structure, means we're likely approaching the end of the 12+ year bull market.What we're currently trying to nail down is whether the fifth wave of the fifth wave of that larger fifth wave has completed or not.Read that again.As I mentioned last update:

Even if SPX manages to make a new high, that will probably be the fifth wave, and (barring an extension) is thus reasonably likely to be followed by a correction (or worse) anyway.

In other words, even if SPX manages to make a new all-time high, we are probably into territory where we should be considering selling the bounces. Let's look at the near-term chart first, with the emphasis that "bull 5," even if it shows up, could very well be the final high of this 12+ year bull market.

Trade safe.

No comments:

Post a Comment