On January 3, I mentioned that I liked the idea of a nearly-immediate top, which would then lead to a c-wave decline below ~4495 -- and while that probably seemed a little crazy at the time, it doesn't seem so crazy anymore, as (at the time of this writing), futures are down at total of about 270 points from the January 4 high, getting very close to the ~4495 target zone.

More recently, the last two updates discussed the near-term count I was leaning toward, as follows:

The low is a micro b-wave, which could run toward SPX 4742-60 in a micro c-wave, before reversing back to break Monday's low [4582].

And this lean, too, was a hit, as SPX broke "Monday's low" of 4592 during yesterday's session.

Accordingly, there's not too much to add to this year's updates, except to note the following (discussion on the intermediate-term chart below):

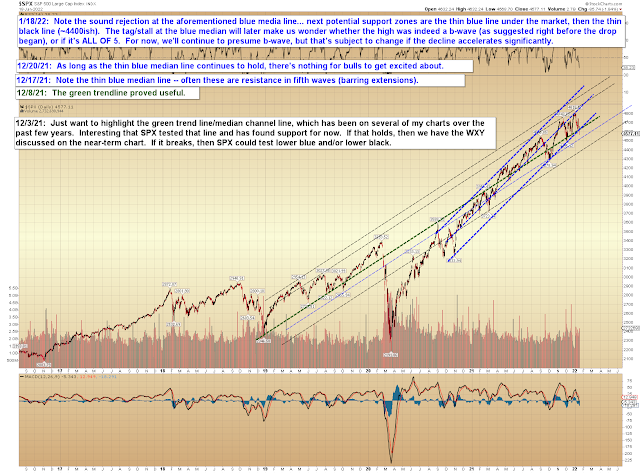

Similar notes on the near-term chart:

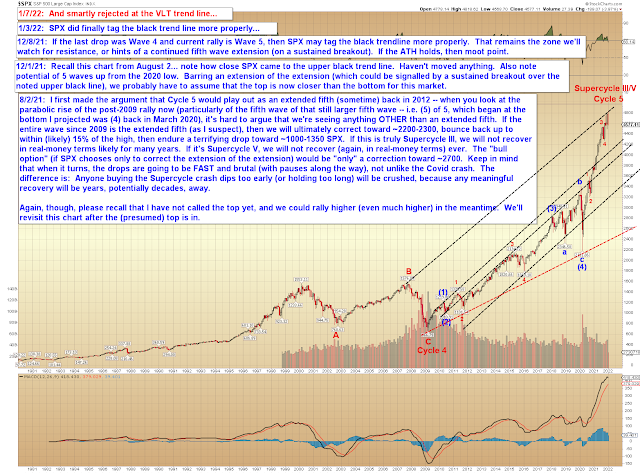

And no update needed to the long-term chart:

In conclusion, SPX continues to be "so far, so good" on following the path I laid out on the first trading day of the year. The main question we'll face next is whether the decline will remain a c-wave at the discussed degree and thus find support (at least in the foreseeable future) and bounce to a new (potentially final) all-time high, or if it will instead turn into something more ominous. Trade safe.

No comments:

Post a Comment