SPX found support at a trend line that I noted in real-time on the forum:

This SPX bounce opens up some questions/options here from a technical perspective, as follows:

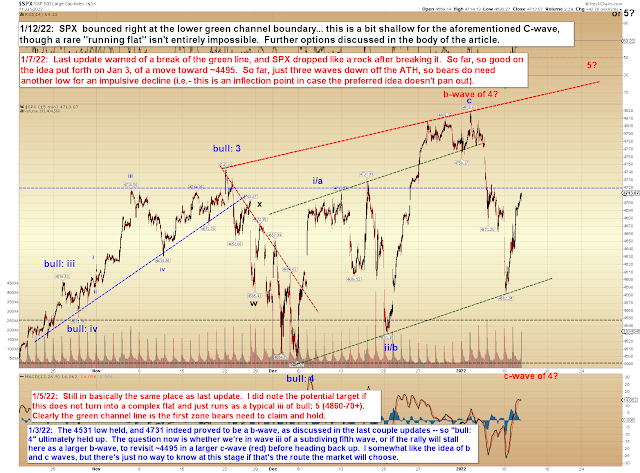

- Wave C played out as a running flat in SPX, instead of the more common expanded flat.

- The low is a micro b-wave, which could run toward SPX 4742-60 in a micro c-wave, before reversing back to break Monday's low.

- The entire larger structure is playing out as an ending diagonal (I mentioned this briefly last year), with the ATH being wave i (or possibly even wave iii) of said diagonal, and the recent drop being wave ii/iv.

- SPX is forming a crazy bull nest to launch wave 5 into a large extension.

Of those, the last one "seems" the least reasonable, from a purely rational perspective -- but I suppose we've seen less reasonable things out of this market.

I think if I had to pick one, I'd probably lean very, very SLIGHTLY toward option 2, as of this exact moment. But that's largely because it seems like the most sensical of the above options -- not because it's particularly clear on the chart.

In conclusion, COMPQ was a hit, but SPX has decided to muddy the water a bit, so we'll see how SPX handles the 42-60 zone first, then take it from there. Trade safe.

No comments:

Post a Comment