The last couple updates suggested that a larger bounce could occur any time in SPX, and here we are. The chart below further elucidates the landscape for both bulls and bears:

Now, we can't rule out bears making a stand sometime soon and turning things lower in order to create an impulsive decline. But right now, all we have in actuality is three waves down, so there's nothing "deterministic" about this pattern and bears should be ready in the event the market elects to disappoint them.

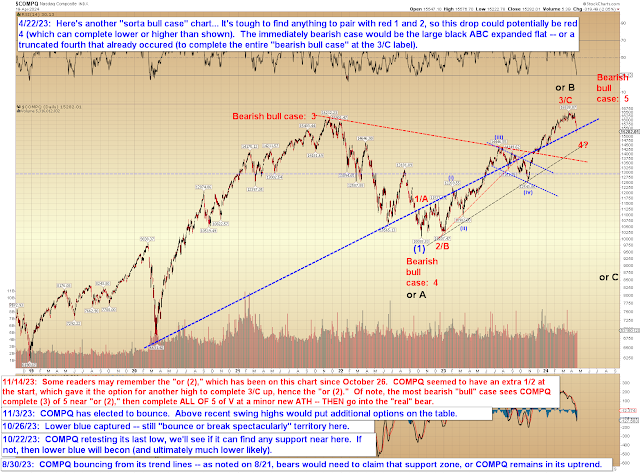

COMPQ is in a similar position, but (more clearly than SPX) seems like it probably "needs" another wave up to new highs, either immediately or a bit down the road. [Note: Please ignore the blue "(1)" on this chart.]

On another, unrelated, note, a few days ago, a friend sent me a link to an interview with the CEO of Redfin, regarding the current real estate market; quoted in part below:

Usually when sales decline, prices drop too, and then sales increase later—that’s the cycle, he said. Homes become affordable again, and sales pick up because of it. This situation is very different. Interest rates are up, and sales volume has fallen through the floor, as he put it, but home prices haven’t followed. “Some of that is just this artifact of 30-year mortgages,” he said. Everything the Federal Reserve is doing has no real effect on homeowners, apart from keeping them where they are. “It actually has the perverse effect of keeping home prices high,” Kelman explained.

Just over two years ago (on April 18, 2022), I went completely against the "everyone knows rising rates will crash housing! Common knowledge!" and instead predicted the following:

Rising rates do, of course, have an impact on future affordability -- but they have no impact on families already in a home (presuming these families have a fixed-rate mortgage, which, as we already covered, the vast majority do). If anything, rising rates might tend to inspire people to hang on to their homes longer instead of putting them up for sale, which would have a tightening effect on inventory. After all, if you're in a mortgage at ~3%, what possible incentive do you have to ever exit that loan with inflation running above or near 8%?As I mentioned earlier, inflation should provide a tailwind for housing -- in more ways than one. If my reasoning above is in the right ballpark, then rising rates may, perhaps counterintuitively, provide impetus for inventory to ultimately balance. Houses might spend more days on market due to fewer buyers, but if fewer homes are being brought to market in the first place because families are incentivized to stay put (or to turn their old 3% mortgage home into a long-term rental), those seemingly-opposed forces could tend to counteract each other.

While I took some flak for that prediction in the Spring of 2022, as it turns out, that's exactly what has come to pass in the years since.

In conclusion, bulls have so far turned the market back up where it was expected and where they needed to. Bigger picture, bulls probably continue to have the advantage unless bears can reverse this and form at least one more new low, to give the decline a more impulsive appearance. Trade safe.